In many countries, economic crises often result in political transformations. In some instances, they lead to cabinet shuffles or even changes of government. They can also give rise to substantial changes in the economic course of a country, as policy priorities shift to counter negative economic trends. Active and effective actions by governments are often crucial in this context. While true for many countries, Russia seems to be the exception in this case.

In many countries, economic crises often result in political transformations. In some instances, they lead to cabinet shuffles or even changes of government. They can also give rise to substantial changes in the economic course of a country, as policy priorities shift to counter negative economic trends. Active and effective actions by governments are often crucial in this context. While true for many countries, Russia seems to be the exception in this case.

In 2014, the Russian economy fell into a full-scale crisis for a second time in 10 years. The first crisis was a result of the global financial meltdown of 2008-2010 and demonstrated the dependence of Russia’s economy on high hydrocarbon prices.

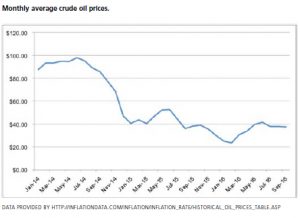

The factors that led to the second crisis were twofold. On the one hand, it was a decline of more than two thirds in the price of oil from slightly more than $100 per barrel in March 2014 to as low as $30 in February 2016. On the other hand, it was sanctions, limiting and prohibiting some international economic activities. They were imposed on certain Russian public figures and, more important, state-affiliated economic enterprises in response to the Russian annexation of Crimea in early 2014.

Many OECD countries, including the U.S., Canada, and, more important, the European Union member states, imposed restrictions, which, for example, prohibited banks and financial institutions mentioned in the ban from applying for credit in these countries’ banks or borrowing money by means of issuing bonds and other securities on international markets. In addition, these countries also prohibited companies residing on their own territory from investing in projects controlled by Russian companies. But perhaps the larger impact on the dynamics of the Russian economy in the post-annexation period came from the counter sanctions that the Russian government imposed against certain economic sectors and industries of western, predominantly European, countries.

Many OECD countries, including the U.S., Canada, and, more important, the European Union member states, imposed restrictions, which, for example, prohibited banks and financial institutions mentioned in the ban from applying for credit in these countries’ banks or borrowing money by means of issuing bonds and other securities on international markets. In addition, these countries also prohibited companies residing on their own territory from investing in projects controlled by Russian companies. But perhaps the larger impact on the dynamics of the Russian economy in the post-annexation period came from the counter sanctions that the Russian government imposed against certain economic sectors and industries of western, predominantly European, countries.

Russian counter sanctions hallmarked the asymmetrical response to anti-Russian policies. Officially, they were introduced in order to protect domestic producers from unfair competition imposed by the west through its sanctions. The most significant part of these counter sanctions was a large-scale ban on importing various food products, including meat, fish, dairy products and vegetables from Europe. While some may treat this as a purely political move by a Russian ruling elite upset at the reactions of other world leaders, others regard this as an opportunity for Russia to finally implement long-term plans to modernize, diversify and re-industrialize its national economy.

Cumulatively, these actions have had a somewhat significant impact on the Russian economy. The steady recovery from the global financial crisis, fuelled by skyrocketing oil prices, was abruptly halted, predominantly by the tectonic shifts in global energy markets. Numerous factors, including innovative excavation methods, the growth of alternative and renewable energy sectors, especially in Europe, Russia’s main market for hydrocarbons, as well as geopolitical factors, such as the removal of the embargo on Iranian oil, contributed to the significant decline in oil prices. Revenues from the energy sector, however, are an important component in the income structure of the Russian budget. To compensate for such a loss, the government had two main options: It could either propose a budget sequestration and thus reduce public expenses, or, alternatively, it could allow the national currency to decline.

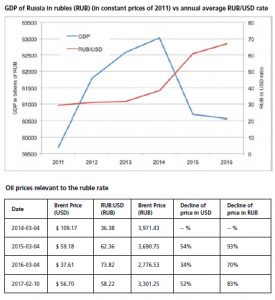

The first neo-conservative approach was fraught with the risk of increasing social tension. Other options, which included borrowing on global financial markets or using internal reserves were not feasible under the given circumstances. On the one hand, global financial markets were restricted due to sanctions; on the other hand, attempts to rely on internal reserves proved ineffective during the previous crisis. Hence, the Russian Central Bank chose to abolish the soft target of the ruble to the U.S. dollar and the euro in late 2014. Whether intentionally or not, by liberating the exchange rate, the Central Bank and the government of Russia were able to compensate for the decline of global oil prices and maintain high levels of budget revenues in rubles.

The first neo-conservative approach was fraught with the risk of increasing social tension. Other options, which included borrowing on global financial markets or using internal reserves were not feasible under the given circumstances. On the one hand, global financial markets were restricted due to sanctions; on the other hand, attempts to rely on internal reserves proved ineffective during the previous crisis. Hence, the Russian Central Bank chose to abolish the soft target of the ruble to the U.S. dollar and the euro in late 2014. Whether intentionally or not, by liberating the exchange rate, the Central Bank and the government of Russia were able to compensate for the decline of global oil prices and maintain high levels of budget revenues in rubles.

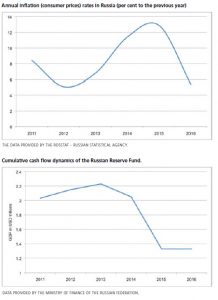

Since mid-2014, the Russian ruble has lost almost half its value in comparison to the U.S. dollar. The decision of the Central Bank, however, had an immediate impact on ordinary Russians. In a resource-oriented economy, the welfare of its citizens is highly dependent on the purchasing power of the national currency. With the rapid deterioration of the ruble’s value, inflation and consumer prices increased substantially, not only on imported products, but also on domestically produced goods. In 2014 and 2015, the inflation rate doubled and reached an annual maximum of 12.9 per cent in 2015.

The food embargo only negatively contributed to the situation, artificially decreasing the quantity of available goods, as plans for substituting the nomenclature of imported items with domestically produced ones did not quickly come to fruition. As a result, retail prices for the majority of essential food products grew by 11-24 per cent annually in 2014 and 2015. While the trend has decreased for 2016, it has not reversed.

The situation also affected the anxiety and societal expectations of ordinary citizens. The Levana-Centre, an independent public opinion research institute, indicated these changes in its regular reports. Thus, by 2016, almost a third of the entire population had spoken on the significant impact of the economic crisis. Indeed, more than two thirds admitted that there is a crisis and expect it will last longer than the previous one. As people cut their personal and family budgets, they also refuse en masse to commit to large and long-term purchases. For example, 2016 was the fourth consecutive year of declines facing the national automobile market. Starting in 2013, sales dropped five per cent in comparison to the previous year, declining 10.4 per cent in 2014. They plummetted in 2015 by 35.7 per cent and fell 11 per cent in 2016. Cumulatively, this represents a 51.3 -per-cent decline in the automobile market between 2014 and 2016.

At the same time, the ruling political elite does not share the pessimistic views on the Russian economy that are reflected in public opinion polls. Instead, they see the current global trends and the counter sanctions as an opportunity to finally fulfil the long-awaited policies aimed at accelerating industrial growth, import substitution, and the increase of food security. The very same ideas hovered in the air in 2008, when the global financial crisis began. Modernization of the national economy was the main slogan of the Dmitry Medvedev presidency (2008-12). The idea was to focus on certain innovative and high-tech industrial spheres and secure governmental budgetary support in order to ensure the flow of investment into these sectors. Yet the plans were a fiasco. The innovation fund, known as Skolkovo and also referred to as the Russian Silicon Valley, failed to achieve substantial progress, revealing many cases of misappropriation of budgetary funds.

Responding to the challenges that emerged in 2014, the Russian government focused on import substitution, particularly emphasizing growth in the agricultural sector, the perennial stumbling block of all economic reforms. In some areas, the lack of international competition and the development of certain consumer niches spurred domestic production. In nominal indicators, growth was even detected in the majority of agricultural spheres, especially livestock, dairy and crops. However, in almost all other sectors, productivity indices (relative to the previous year) have declined since 2014, magnified by the growing deterioration of basic production assets.

The fact that the Kremlin’s plan for import substitution does not work as expected could be illustrated through the cash-flow dynamics of the National Reserve Fund. Launched in 2004 as the Stabilization Fund against the backdrop of rising oil prices, it was designed to compensate the deficit of the national budget should oil prices go down. As the economic situation has deteriorated, use of the fund has grown, reducing it considerably to approximately one per cent of GDP today.

Reflecting on the conditions of the Russian economy and the government’s attempts to manage the crisis, many expressed quite pessimistic views. A majority of respondents to a PriceWaterhouseCoopers Russia study pointed out negative trends in the Russian economy, specifically the rise in prices for purchased materials (77 per cent), decline in demand (62 per cent), and the inability to finance new projects (53 per cent).

Overall, Russian business draws a pessimistic picture of the consequences of the crisis for the national economy. First, there are low expectations from import substitution to spur economic growth. In addition to this, they expect that the two almost consecutive crises will change the habits and behaviour of consumers from spending to saving.

Finally, the introduction of sanctions and the subsequent reaction of the Kremlin divided academics into two separate and seemingly irreconcilable camps. The liberal opposition camp described future development in terms of “the battle between the fridge and the TV set.” They argue that the continuous deterioration of economic conditions would inevitably and negatively affect the welfare of ordinary citizens and, subsequently, result in the growth of discontent that would shake the stability of Putin’s political regime. Needless to say, they see Russia’s development in the context of the conventional global paradigm, linking growth and prosperity of the country to its inclusion in the global market through multiple international co-operation agreements and trade unions. Conventional logic implies that international competition, combined with proper infrastructural reforms would foster diversification and ensure the growth of the national economy. Any deviation from such a path is baneful.

Sergei Guriev, the chief economist of the European Bank of Reconstruction and Development and the former president of the Russian Economic School, an independent Moscow-based university, argues that while sanctions deteriorate the economic conditions in Russia, the major cause has been declining oil and other commodity prices and Russia’s dependence on them. This opinion was echoed by another famous Russian economist and current University of Chicago professor, Konstantin Sonin. He argues, in his paper “Two Crises: 2014 and 1991” that the current measures of the government will not be successful without contract law, independent courts, non-corrupt police, accountable government and free media.

Such views have been opposed by an impressive group of economists, led by Sergey Glaziev, the presidential adviser for economic affairs. They criticize and accuse the government and the Central Bank of implementing liberal monetary policies that result in the freefall of the national currency and subsequent freeze of cash flow in real sectors. They tend to disregard the crucial importance of political institutional factors, emphasized by their opponents from the liberal economic camp, focusing solely on economic indicators. They came up with a rather paradoxical hypothesis that the combination of such factors as the economic sanctions, fall in oil prices, the outflow of capital and devaluation of the ruble may lead to the fact that, according to Russian economist Vladimir Popov, “Russia may finally see an acceleration of growth.”

As often occurs, the actual developments disproved the forecasts of both camps. The truth appeared somewhere in between the two opposing views. The reality showed that the crisis didn’t prompt political changes and elite rotation, nor did the government measures spur economic growth. Volatility of global political processes and the genuine discontent of most of the Russian people about the politics of western countries towards Russia create fertile soil for growing the seeds of propaganda fast enough and maintaining high levels of personal support for the political leaders, especially President Vladimir Putin. However, by focusing on the foreign policy agenda, the Russian leadership ignores the need for structural reforms, especially anti-corruption measures, which are crucial to assure steady economic growth.

Mikhail Zherebtsov is a post-doctoral fellow at Carleton University’s Institute of European, Russian and Eurasian Studies.