Canada lags in productivity — maybe Trump’s threats to its economy and its sovereignty are the incentive it needs.

Donald Trump may actually be doing Canada a favour and make the country an exciting place to live and do business. It may not seem that way because Donald Trump’s trade wars with Canada — and other countries — have created a lot of political uncertainty that is scaring investors away and sending a damp chill through global — and Canadian — markets.

So too have his public ruminations about making Canada the 51st state, which have riled Canadian politicians along all points of the political spectrum and ignited the fires of nationalism among the Canadian public. Long gone are the days when Canadians would politely nod in agreement when their former prime minister, Justin Trudeau, suggested the country could be considered the world’s “first post-national state.” Today, Canadians are flying the Maple Leaf and pinning it to their lapels with a fierce sense of national pride.

Importantly, this is provoking a serious debate in the country about how to revive Canada’s competitive edge in order to attract investment and production thereby reducing Canada’s dependence on the United States.

The options include deepening internal markets with the removal of interprovincial trade barriers, spurring growth and innovation through regulatory changes especially in resource development, changing tax structures to promote capital investment and talent retention and recruitment by Canadian firms, and, more generally, creating a more competitive environment for business.

Whether Canada’s new government can actually deliver on these goals remains to be seen. It is going to require a lot of heavy lifting, the expenditure of political capital and a willingness to make some tough choices that will not prompt everyone to stand up and cheer.

Canada’s productivity slide

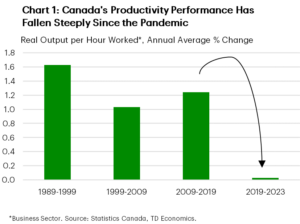

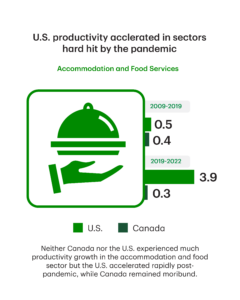

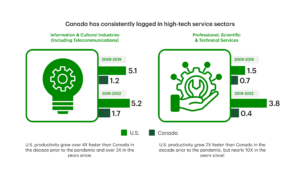

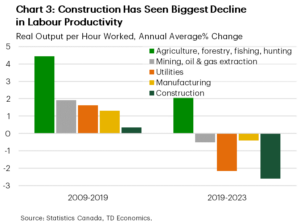

However, we have to first recognize that Canada’s economic problems did not start with Donald Trump. A longstanding sour note in the country’s discordant economic arpeggio is its woeful productivity slowdown.

Canada continues to underperform compared to its economic peers. Per-capita output, a key measure of productivity — has fallen over the past 20 years. The average per capita income in Canada today is still what it was in 2015 when the Liberals came to power. The median wages of Canadians have been stuck in neutral since the late 1970s, which is why most households now require two wage earners to get by. The wealth gap between Canada and the United States has also grown. In 2002, our per capita GDP was roughly 80 per cent that of the U.S.— a 20 per cent spread — but the difference is now 30 per cent.

As Carolyn Rogers, Canada’s deputy governor of the Bank of Canada, starkly pointed out, Canada has to raise labour productivity, increase capital intensity (i.e., give workers better tools so they can be more productive) and ensure that people have the right skills and training for their jobs, using capital and labour together more efficiently.

Ironically, by dialing back on immigration, as the government is now doing, Canadians businesses will be forced to substitute capital for labour and will no longer be able to take the easy way out by doing the opposite, as they have done for years. Higher tariffs in the U.S. market will also offset Canada’s lower (and falling) exchange rate, which, again, will force Canadian businesses to be more innovative and productive if they are to compete globally and south of the border.

As Trump moves to make the U.S. more competitive by lowering personal income and business tax rates, one of his key election promises, Canada will be forced to do the same. Specifically, he is planning to reduce the corporate tax rate for domestic manufacturers from 21 to 15 per cent, which, according to some estimates, would increase long-run U.S. economic output by 0.2 per cent. Trump has also proposed eliminating the green energy tax credits put in place by the Biden administration’s Inflation Reduction Act (IRA). Trump also plans to reduce personal income taxes while eliminating taxes on social security payments to seniors.

The private sector will only invest if Canada’s tax system encourages investment, and its regulatory system is not too burdensome. If Canada diverges too sharply from U.S. tax, regulatory and energy development policies, Canada will further lose its competitive edge regardless of Trump’s tariffs. That means reducing Canada’s tax burden on corporations and individuals, which are among the highest in the industrialized world.)

As the Canadian Tax Federation points out, there is already a stark gap between Canadian and U.S. personal income tax levels. “For example, a taxpayer in Ontario earning $75,000 a year pays an income tax rate of about 30 per cent. Compare that to the two states bordering Ontario: Michigan and New York. In Michigan, a taxpayer earning $75,000 a year pays a 26.3 per cent income tax rate. And in New York, one of the highest-taxed states in the U.S., that taxpayer would face a 27.5 per cent income tax bill. Considering that sales taxes and hydro rates are lower south of the border, Canada is clearly at a disadvantage. Add to that the fact that Canadians pay a punishing carbon tax while Americans don’t.”

That gap will only grow under Trump unless we do something about it.

Copyright by World Economic Forum

swiss-image.ch/Photo Moritz Hager

Fortunately, that message is beginning to sink in. All of Canada’s political parties, including Prime Minister Mark Carney, want to get rid of the Liberal’s carbon tax. The Liberal government also reversed course on increases to the capital gains tax first announced in the 2024 federal budget. But, as many are now urging, more business and personal tax reductions will almost certainly be necessary to keep Canada competitive.

At the same time, Canada will also have to reduce its regulatory overburden, particularly in the resource sector. Canada’s overly complicated and lengthy regulatory processes for new project approvals, drug approvals), along with interprovincial trade barriers, are also brakes on investment and growth.

Canada’s premiers and federal officials are now seriously considering cutting interprovincial trade barriers to offset the economic damage of a looming trade war with the United States. Doing so could potentially “lower prices by up to 15 per cent, boost productivity by up to seven per cent and add up to $200 billion to the domestic economy” as former Liberal internal trade minister, Anita Anan, noted earlier this year.

The real barriers to greater interprovincial trade, of course, are provincial and local government public procurement policies for goods and services and labour regulations, which benefit local workers and unions, which are hard political nuts to crack. However, as Ottawa ramps up public spending on major infrastructure projects to rebuild roads, sewers, pipelines, transportation networks (including ports, airports and rail systems), and the country’s communications infrastructure, it can attach conditionality to jointly funded or federally funded projects by insisting that they be open to suppliers and workers from across Canada.

Seeing new foreign trade partners

Trade and investment diversification must also be at the forefront of Canada’s economic policies in order to reduce Canada’s dependence on and vulnerability to the American market, which has grown increasingly protectionist during the 21st century. There are promising prospects in Asia and not just with India and China with which Canada has difficult and problematic relations, but other countries in the region which need our agricultural and energy exports such as Japan, Korea, Indonesia, Malaysia, Vietnam and the Philippines.

In the case of Europe, Germany and the UK are potentially key trading partners, especially for liquefied natural gas in the case of Germany. However, that will require building a West-to-East pipeline and not rejecting the “business case” outright as former prime minister Justin Trudeau did when several European leaders first floated the idea of Canadian LNG shipments to Europe with him.

LNG is vital to reducing the carbon footprint of countries which still rely on coal, as Germany, Poland, Czechia, Italy and other European countries do, for power generation. Converting coal-fired plants to natural gas is a much simpler transitional step than the alternatives and modern combined cycle gas turbines can reduce carbon emissions by 60 per cent or more compared to similar coal-fired power plants. According to a recent study by the National Bank of Canada, “partially replacing India’s coal-fired power generation with Canadian LNG would have a more profound impact on the planet than shutting down the Canadian economy entirely.”

The drag of big government on the country’s economic growth will also have be addressed. The federal government has been running a structural deficit of 1.3 percent of GDP because spending has outpaced revenues. One of the main drivers of program spending is public service growth. In 2015, when the Liberal took office, there were 257,000 federal public servants. In 2024, there were 368,000 — a whopping 40 per cent increase. As a result, growth in federal public service has been roughly three times faster than the general workforce over this same period. This has diverted both capital and labour from the private sector, a situation that is simply not sustainable.

The newfound sense of Canadian nationalism in reaction to Donald Trump is also proving to be a boon to local businesses as Canadians turn to buying locally made goods and produce. It is not just grocery stores that looking to ride this wave. But also restaurants, hotels, retail outlets, and sporting events are promoting national pride to ensure that what is now a fad becomes an ingrown consumer habit.

The same is also true of tourism. Canadians are cancelling their travel plans to the U.S., which presents a newfound opportunity to market Canada as travel destinations for Canadians so that they see their country and spend their dollars at home and not abroad.

Trump may not be exactly a silver lining in a silk purse for Canada or much of the world. But if finally forces us to get our house in order and do some things we should have done a long time ago to get our economic house in order, we can adapt and turn a crisis to our advantage.

Fen Osler Hampson is the Chancellor’s Professor and professor of International Affairs at Carleton University. Tim Sargent is a senior fellow and the director of the domestic policy Program at the Macdonald-Laurier Institute, and distinguished fellow at the Centre for International Governance Innovation.